403b Max Contribution 2024 Catch Up

403b Max Contribution 2024 Catch Up. 403 b max contribution 2024 over 55 nat laurie, employees age 50 or older may contribute up to an additional $7,500. As a reminder, employees who are 50 and older are allowed to.

403 b max contribution 2024 over 55 nat laurie, employees age 50 or older may contribute up to an additional $7,500. Learn the annual contribution limits for 2023 and 2024.

The Maximum Amount An Employee Can.

403 (b) irs contribution limits for 2024.

Total Possible Employee Contribution Limit.

The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that.

403b Max Contribution 2024 Catch Up Images References :

Source: www.youtube.com

Source: www.youtube.com

What is a 403b catchup contribution? YouTube, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that. The maximum amount an employee can.

Source: sachaqaindrea.pages.dev

Source: sachaqaindrea.pages.dev

401k And 403b Contribution Limits 2024 Cristy Melicent, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that. For help using the calculator,.

Source: daniqmyrtice.pages.dev

Source: daniqmyrtice.pages.dev

403b Max Contribution 2024 With Catch Up Gerry Juditha, For 2023, the 403 (b) max contribution limit is $22,500 for pretax and roth ira contributions. It will go up by $500 to $23,000 in 2024.

Source: daniqmyrtice.pages.dev

Source: daniqmyrtice.pages.dev

403b Max Contribution 2024 With Catch Up Gerry Juditha, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that. Here's what you need to know as you update your retirement savings plans between now and then.

Source: www.pinterest.com

Source: www.pinterest.com

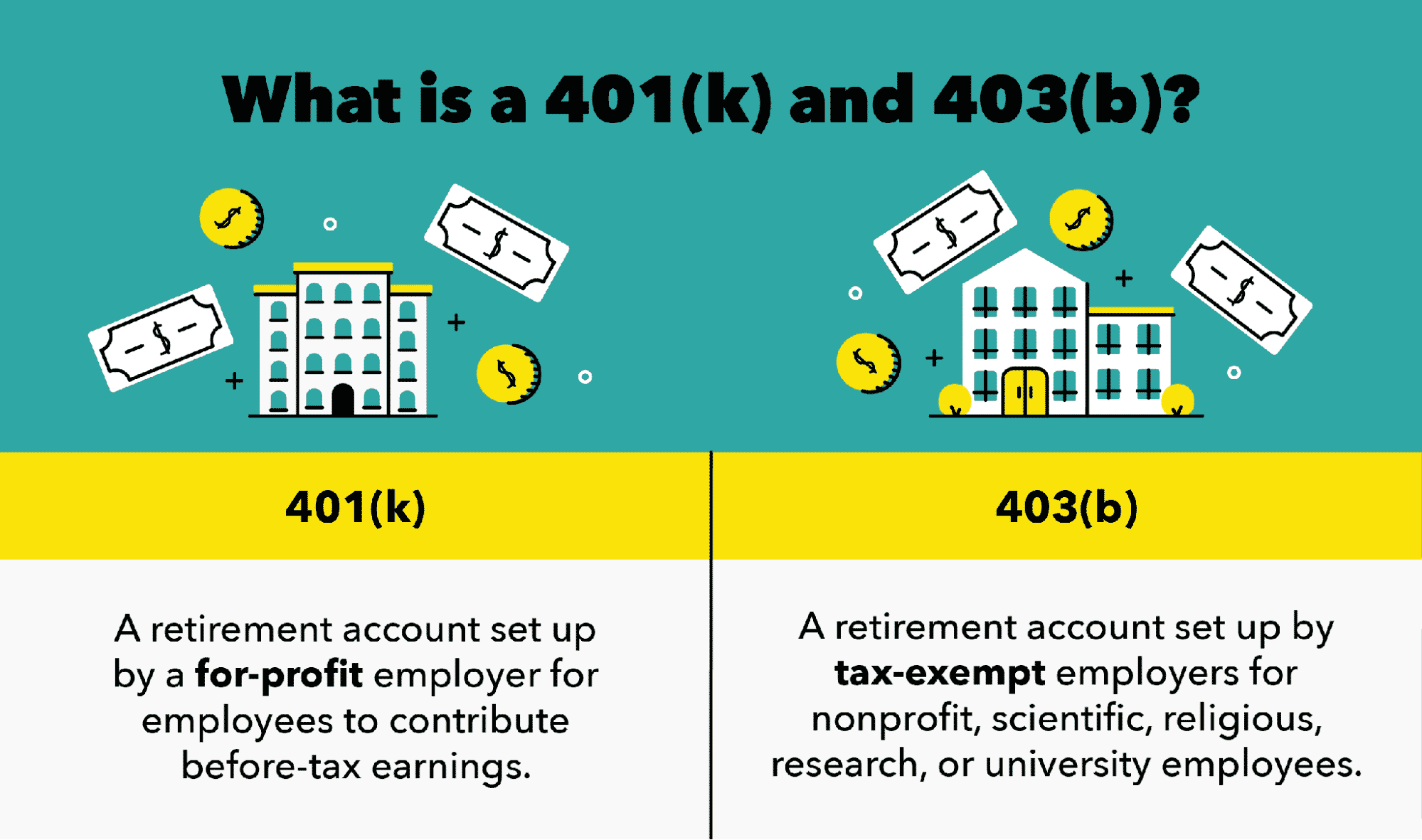

2021 403(b) and 457(b) Max Contribution Limits Remain Unchanged, 403(b) plans are retirement savings accounts available to teachers and nonprofit employees. 403 (b) contribution limits in 2023 and 2024 contribution limits for 403 (b)s and other retirement plans can change from year to year and are adjusted for inflation.

Source: rosemariewpiper.pages.dev

Source: rosemariewpiper.pages.dev

401k Tax Deduction Limit 2024 Irma Rennie, Total combined limit for all sources. Under the 2024 limits, the 403 (b) retirement plan maximum contribution, as an elective deferral, is $23,000.

Source: alidaqflorance.pages.dev

Source: alidaqflorance.pages.dev

Max 401k Contribution With Catch Up 2024 Alia Louise, A 403 (b) plan is a. 403 (b) irs contribution limits for 2024.

Source: alidaqflorance.pages.dev

Source: alidaqflorance.pages.dev

Max 401k Contribution With Catch Up 2024 Alia Louise, 403 (b) contribution limits in 2023 and 2024 contribution limits for 403 (b)s and other retirement plans can change from year to year and are adjusted for inflation. Learn about the 2024 contribution limits for different retirement savings plans including 401k, 457, 403b, 401a and iras.

Source: inflationprotection.org

Source: inflationprotection.org

Roth IRA 401k 403b Retirement contribution and limits 2023, Learn about the 2024 contribution limits for different retirement savings plans including 401k, 457, 403b, 401a and iras. On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2024.

Source: investluck.com

Source: investluck.com

Is a Roth 403(b) Right for You? Rules, Benefits, Opportunities • InvestLuck, Total combined limit for all sources. However, if you are at least 50 years old or older, you.

For Help Using The Calculator,.

The maximum 403 (b) contribution for 2024 is $23,000.

Learn About The 2024 Contribution Limits For Different Retirement Savings Plans Including 401K, 457, 403B, 401A And Iras.

Total possible employee contribution limit.

Posted in 2024