Duval County Sales Tax 2024

Duval County Sales Tax 2024. Duval county, florida sales tax rate. Your total sales tax rate combines the florida state tax (6.00%) and the duval county sales tax (1.50%).

• current 1% local government infrastructure surtax is. Florida dor announces 7.5 percent combined sales tax for duval county, effective jan.

The Different Sales Tax Rates Like State Sales Tax, County Tax Rate And City Tax Rate In Duval County Are 6.00%, 0.99% And 0.00%.

Your total sales tax rate combines the florida state tax (6.00%) and the duval county sales tax (1.50%).

The Duval County Sales Tax Calculator Allows You To Calculate The Cost Of A Product (S) Or Service (S) In Duval County, Florida.

For 2024, the following county has a surtax rate change:

Florida Commercial Renters And Landlords Can Expect Another Sales Tax Rate Reduction In 2024!

11/23 page 2 of 2.

Images References :

Source: us.icalculator.info

Source: us.icalculator.info

Duval County, Florida Sales Tax Comparison Calculator US T, 731 rows florida has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 1.5%. The duval county sales tax rate is %.

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, 24, 2020, 9:00 pm pst. The duval county sales tax calculator allows you to calculate the cost of a product (s) or service (s) in duval county, florida.

Source: www.carsalerental.com

Source: www.carsalerental.com

Duval County Sales Tax On Cars Car Sale and Rentals, This is the total of state and county sales tax rates. Here's how duval county's maximum sales tax rate of 7.5% compares to other counties around the united states:

Source: www.carsalerental.com

Source: www.carsalerental.com

Duval County Sales Tax On Cars Car Sale and Rentals, Sales tax in duval county, florida, is currently 7%. Duval county sales tax calculator for 2024/25.

Source: ohiomemory.org

Source: ohiomemory.org

CONTENTdm, The duval county, florida sales tax is 7.00% ,. Check sales tax rates by cities in duval county.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, The current total local sales tax rate in duval county, fl is 7.500%. Effective december 1, 2023, the state of florida’s sales tax rate on commercial real property lease payments (including base rent and additional rent) will be.

Source: myemail.constantcontact.com

Source: myemail.constantcontact.com

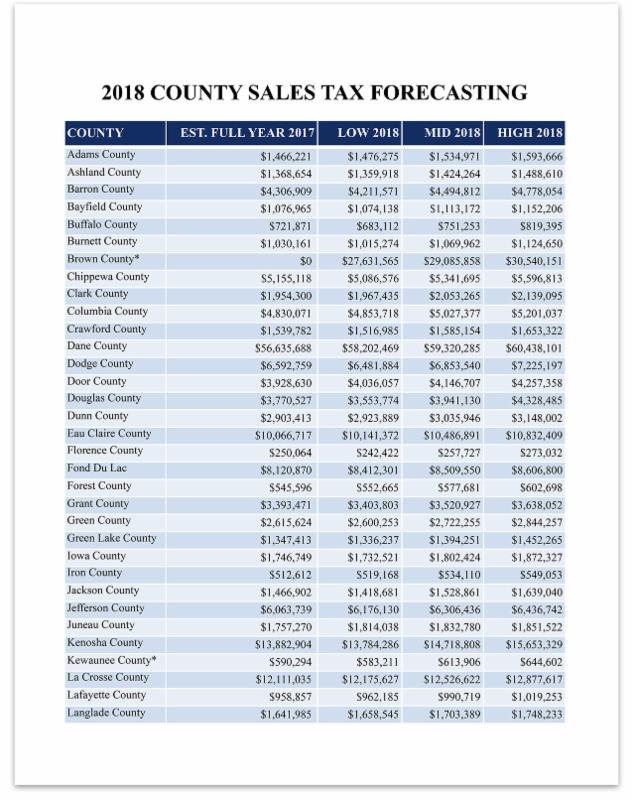

COUNTY SALES TAX FORECASTING, The sales tax rate in duval county, florida is 7.5%. For 2024, the following county has a surtax rate change:

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Effective december 1, 2023, the state of florida’s sales tax rate on commercial real property lease payments (including base rent and additional rent) will be. Your total sales tax rate combines the florida state tax (6.00%) and the duval county sales tax (1.50%).

Source: www.strashny.com

Source: www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny, 731 rows florida has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 1.5%. There are a total of 362 local tax jurisdictions across the state, collecting an.

Source: www.yelp.com

Source: www.yelp.com

DUVAL COUNTY TAX COLLECTOR’S OFFICE 35 Reviews 12220 Atlantic Blvd, For duval county, the state rate reduction to 4.5% comes into play. The different sales tax rates like state sales tax, county tax rate and city tax rate in duval county are 6.00%, 0.99% and 0.00%.

Higher Maximum Sales Tax Than Any Other Florida Counties.

Florida dor announces 7.5 percent combined sales tax for duval county, effective jan.

Duval County, Florida Sales Tax Rate.

• current 1% local government infrastructure surtax is.

Components Of The 7% Jacksonville Sales Tax.

Florida's general state sales tax rate is 6% with the following exceptions:

Posted in 2024